Mean Reversion Trading

One thing that I’ve learned over the course of my trading education is that the simplest strategies are the best. I initially started my blogs because I wanted to help aspiring traders find their footing and start finally making money in the “trading game”.

Throughout “internet land” you will find discussion after discussion, argument after argument, post after post debating the best indicators, the best trading strategy, the best…. you name it, it’s out there and someone has a very strong opinion about what you need to do or what you should be looking at to gain success.

The reality is, there are thousands of ways to approach the markets and there is no single system or method that is the “best”. There are many great ways to trade that allow traders to make incredible returns from the market.

In my opinion, the simple systems work the best because the simple systems are duplicatable. It is key to be able to understand all of the aspects of the method so that you can personalize it for your mindset and trading personality. The better your understanding of the trading method, the more likely you are to follow it and stick with your trading rules.

What I’m going to show you here is a simple trading method that can be quite profitable over time and easily duplicated. The best part of this strategy is that it can be used to identify trading opportunities with Stocks, Futures, or even Forex instruments.

You will not win every trade, but of course, as an educated investor, you already know that. This strategy will give you an edge in the marketplace and, if executed effectively, can help you be profitable over time.

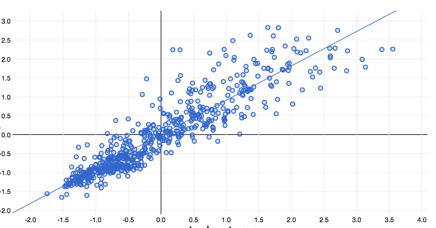

So, what is “mean reversion” and how can it help me with trading? Mean reversion is a theory that suggests that prices or returns will eventually move back toward the average, or mean, if they have recently traded outside of that historical average.

For example, if a trader has a historical performance of returning 20% per year after year for the past 10 years and he or she suddenly earns 45% this past year, mean reversion would suggest that this recent year is an outlier and next year’s performance would be close to 20% again.

Another example using stock would be as follows. If AAPL typically trades in a 1.5 point range but suddenly trades in a 4 point range one day, we would expect it to return back to it’s average, or mean, shortly after. We would not expect the 4 point volatility to occur over a long period because it is so far outside of the average.

We can use this information to easily create a trading method using a breakout trading strategy combined with analysis of the average trading range for the instruments that we are trading.

How can I use this to identify potential trades? Since we have identified that simple math principles dictate the potential for prices to return to their typical trends following an outlying event, we simply scan the market for outliers.

One easy to implement strategy uses a breakout trading method in conjunction with the scan for unusual market events. Here is how it works:

- Calculate the Average Trading Range over the past 20 periods for the instruments that you typically trade.

- Pro Tip: It is helpful to have a basket of items to watch. Since we are looking for outliers, we need multiple items on our watch list in order to improve our odds of finding trading opportunities.

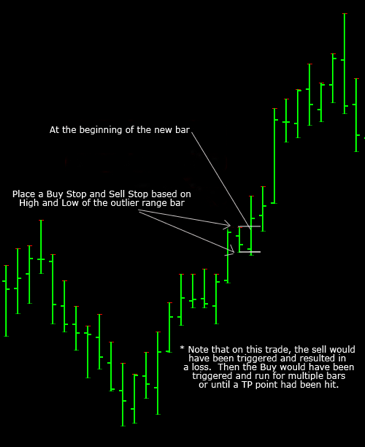

- Scan the market at the beginning of a new trading period and look for a bar/candle that is significantly smaller than the average range.

- Pro Tip: For example, if the average range for the EURUSD on a daily period is 70 pips, and the previous day closed by only moving 35 pips, this would alert us to a potential trade as the range is significantly lower than the average.

- If the previous period has traded at 75% or less than the average range for that instrument, then we would place a bracket order at the start of the new period by placing a buy stop at the top of the previous day’s range and a sell stop at the bottom of the previous day’s range.

- Pro Tip: See the example below for a visual reference

- Place your stop loss points near the high/low of the previous day as well

- As the trading active returns to normal, the price will breakout of the top or bottom of the previous day thereby activating the trade. To manage the trade, you could consider using any number or trade management tools or any combination that best fits your trading personality.

- Fixed point trailing stop loss

- ATR trailing stop loss

- 1:1 profit target, 2:1 profit target

- ATR based profit target

- Take Profit at the end of a specified period

- Pro Tip: Trade management is very important. The exit strategy may vary based on the time frame that is being traded. It is important to test and see what works best for the instrument you are trading and your trading mindset.

Other Considerations:

I hope this brief write up has given you some points to ponder and has helped you begin thinking through ways to apply the trading strategy. Some other items to consider as you think through your trade management criteria would be:

- Risk Management

- Trade Size

- Mindset

- Trade offs during trade management

- Developing your own trading plan

Stay tuned for additional articles in the next few days that will provide more detail on each of these subjects. A deep understanding of these items will help you formulate a plan that works for your specific trading style and risk appetite.

Summary:

As I mentioned, this trading strategy is quite simple. It works best on volatile instruments with wider average ranges but can be applied to anything out there with enough patience. You will not win every trade, but over time you will find that this gives you an advantage in the market place that is based on a solid mathematical principle. Using this consistently could give you the edge that you need to become a successful trader.

Be sure to register for the FREE member’s area with full training courses for the simple strategies that work! You’ll get full training as daily market updates to help you along:

http://makemoneyfromyourlaptop.com

Best wishes in your future trading endeavors!

Kind Regards,

Brian